Thank you for visiting us.

This is conspi public relations.

This time, it was distributed on CONSPIRIT's official channel on YOUTUBE.

Episode 17: Boost your quality of life with real estate management!I would like to send you the contents.

Apartment prices continue to rise even amid the coronavirus pandemic.

Nevertheless, it seems that there is still strong demand, and many people may be considering purchasing one.

So, this time we'll be looking at loans, which most people will use when purchasing real estate.

This is a basic explanation of how to repay the loan.

When purchasing income-generating real estate, this is of course also related to home loans, so be sure to review the basics.

Types of Loans

Loans are divided into two types based on the repayment method.

There are two types: the "equal principal and interest method" and the "equal principal payment method."

Although there is only a one letter difference, the contents are quite different, so let's take a look at each one.

What is the equal principal and interest method?

The first is the "equal principal and interest method."

I'm sure there are many people who have received apartment financing or home loans using this method.

As the name suggests, the equal repayment method involves paying back the borrowed amount (principal) and the interest accrued on the borrowed amount in equal installments.

The advantage of this is that your monthly repayments will always remain constant.

To put it in extreme terms, if the interest rate does not change at all during the loan period, the first repayment amount will be the same as the repayment amount 30 years later.

Therefore, since the repayment amount is fixed, it is relatively easy to make a repayment plan, and this repayment method is popular with many users.

When it comes to purchasing general income-generating properties, I think non-banks often adopt the equal principal and interest payment method.

However, the fact that the repayment amount is fixed means that when interest rates rise, the ratio of principal and interest within the same amount is adjusted, so in extreme cases, if interest rates rise dramatically, most of the repayment amount may become interest. In that case, the principal amount will not decrease, so there is a possibility that you will have to pay a lump sum when you finish paying off the loan, so please be careful.

What is the equal principal payment method?

Next, let's look at the characteristics of the "equal principal payment method."

This repayment method involves paying the principal amount borrowed in equal installments over the repayment period, plus interest on the remaining balance.

The monthly repayment amount is calculated by adding interest to the principal balance, so as the balance decreases, the interest amount also decreases.

The repayment amount is highest at the beginning of repayment and decreases over time.

The amount of principal repayment is fixed each month, but the amount of interest repayment varies depending on the remaining loan balance.

Compared to equal principal and interest repayments, the burden of the initial payment is greater, so the repayment ratio and other conditions also increase, resulting in a lower loan amount than with equal principal and interest repayments.

On the other hand, since the principal amount decreases quickly, the total payment amount is overwhelmingly less with equal principal payments.

Let's illustrate it.

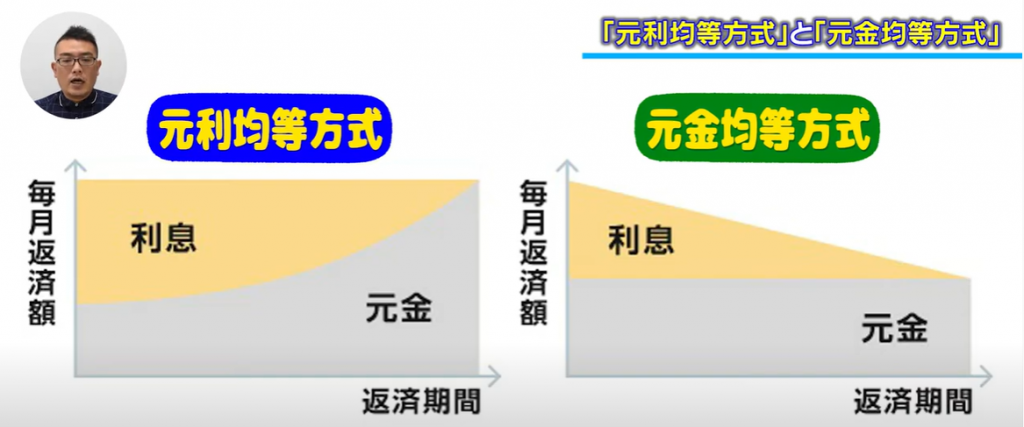

Now that we have understood the characteristics of each, let's illustrate them together.

The diagram on the left shows "equal principal and interest."

When you first start making payments, the interest portion is far greater than the principal, and gradually the principal portion increases.

In contrast, the graph on the right, "Equal Principal Payments," shows that the principal remains constant until the end of repayment, and is represented in an approximately rectangular shape.

We often see debates about which is more advantageous, but if you consider lowering the total repayment amount to be more advantageous, then the equal principal payment method wins. However, the general idea is to choose based on your life cycle and plans.

Choosing the loan repayment method is a very important decision, so if you are thinking of buying a home, please do your research properly before making your choice.

Learn about real estate management

If you likeConspirit official channelPlease also take a look.

Please subscribe to the channel and give us a high rating!

Well then, it was Conspi PR!

The person who wrote this blog

conspirit public relations

We disseminate information both internally and externally to improve our company's awareness and brand power. We conduct promotional activities by clarifying reach methods based on market, competitor, and company research and analysis.