Inheritance tax is a tax obligation that arises when a spouse, parent, etc. dies and an inheritance occurs.

The larger the total assets, the greater the tax burden, and if there are many inheritances that take time to convert into cash, such as land or stocks, there are often insufficient funds to pay taxes.

This time,How to calculate inheritance taxWe will explain in detail. Please use this information to understand whether you have a tax liability and whether you have enough funds to pay the tax, and to plan your inheritance in the future.

Who pays inheritance tax and who does not have to pay it

Not everyone who inherits an estate is required to declare and pay inheritance tax.

Inheritance tax may be waived if the total amount of the estate is within the basic exemption range or if a tax credit is applied.

When tax-free within the basic deduction range

There is a basic deduction for inheritance tax, and if the total amount of inheritance is within the range of the basic deduction, there is no need to pay inheritance tax.

The basic deduction amount is calculated using the following formula.

(Basic deduction amount) = 30 million yen + 6 million yen x number of legal heirs

A legal heir is an heir stipulated by civil law. The spouse is always the heir, with children in first place, parents in second place, and brothers and sisters in third place.

If a person with a higher rank becomes an heir, a person with a lower rank will not become an heir.

For example, if the decedent has no children but a spouse and father, the spouse and father will be the heirs. Even if there are other surviving siblings, they will not become heirs.

When tax is exempt due to tax credit

In addition to the basic deduction, tax credits may be applicable for inheritance tax.

For example, in the case of a spouse,160 million yenmosquitolegal inheritanceThere is no inheritance tax up to the greater of either amount.

In addition, in the case of a minor, 100,000 yen x the number of years until the minor becomes an adult will be deducted from inheritance tax.

In addition, there are various special deduction systems such as disability deduction and gift tax deduction, so if you meet the requirements for each, the tax deduction will be applied.

How to calculate inheritance tax

Inheritance tax is not calculated by simply multiplying the inheritance amount by the tax rate, but is calculated using a slightly more complex calculation method.

The amount of inheritance tax paid by each heir will vary depending on the number of heirs and who inherited what kind of inheritance.

Specifically, the tax amount is calculated using the following steps.

Calculate the total amount of inheritance

First, we calculate the total amount of the estate, which is the basis for calculating inheritance tax.

Inheritance includes positive assets such as cash deposits, real estate, stocks, cars, and precious metals, as well as negative assets such as debts and unpaid taxes.

However, some assets are exempt from taxation.

For example, assets related to religion and rituals (Buddhist altars, tombstones, etc.) and life insurance proceeds5 million yen x number of legal heirsRegarding the amount calculated intax exempt propertyTherefore, these can be deducted from the total amount of the estate.

Calculate the total amount of the inheritance and subtract the negative assets from the positive assets to get the total net inheritance.

Calculate the total amount of taxable inheritance

The total amount of taxable inheritance is the amount obtained by subtracting the basic deduction amount mentioned earlier from the net total amount of inheritance. If the amount after deducting the basic deduction amount is less than zero, inheritance tax will not be payable.

Calculate the total amount of inheritance tax

Now it's time to calculate the specific tax amount.

Inheritance tax is calculated by multiplying the amount of inheritance by a prescribed tax rate, but the amount of inheritance that each heir inherits is calculated assuming that the inheritance is based on the legal inheritance.

The total amount of inheritance tax is calculated by multiplying the amount of each estate by the specified tax rate.

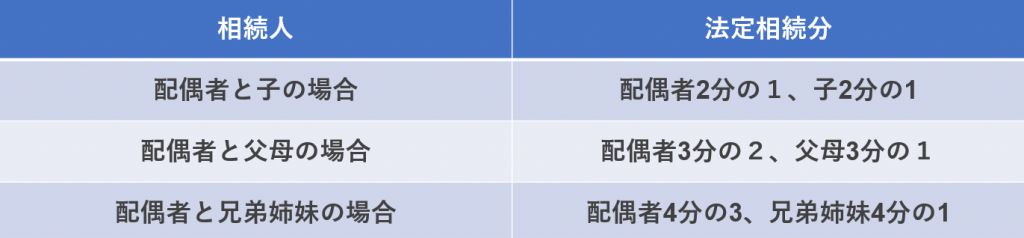

Legal inheritance is determined by the Civil Code as follows:

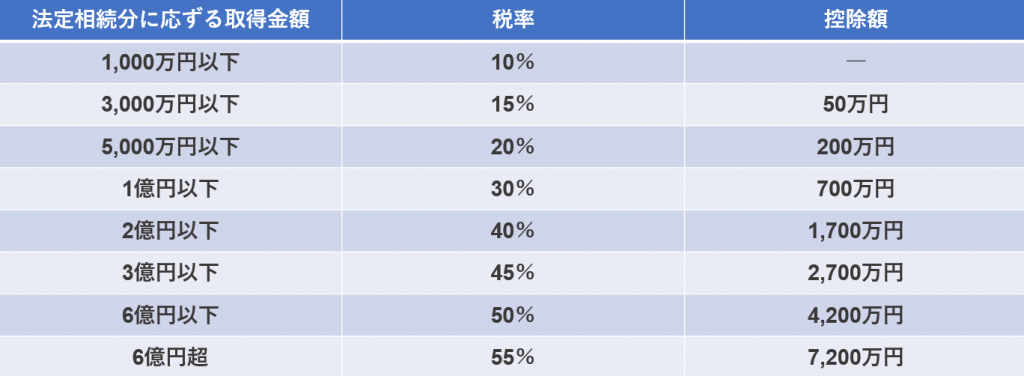

The inheritance tax rate is as follows.

*Quoted from the National Tax Agency website

Let's calculate the inheritance tax amount using the example below.

(example)

・Heirs: spouse and 2 children

・Total taxable inheritance: 80 million yen

The legal inheritance is 40 million yen for the spouse and 20 million yen for the children, so inheritance tax is calculated as follows.

Spouse 40 million yen x 20% - 2 million yen = 6 million yen

Child 20 million yen x 15% - 500,000 yen = 2.5 million yen

Total inheritance tax: 6 million yen + 2.5 million yen x 2 = 11 million yen

Apply tax deductions to each heir on a pro rata basis

The total amount of inheritance tax is calculated based on the statutory inheritance amount, but in many cases the inheritance that an heir inherits will actually be inherited at a rate different from the statutory inheritance amount.

In that case, the total amount of inheritance tax will be divided proportionally to the proportion of the inheritance actually inherited, and the amount will be declared as the amount of inheritance tax.

For example, in the previous example, if the spouse actually inherited 60 million yen and the child inherited 10 million yen each, the amounts would be divided as follows:

Spouse's inheritance tax amount: 11 million yen x (6,000/8,000) = 8.25 million yen

Child's inheritance tax amount: 11 million yen x (1,000/8,000) = 1.375 million yen

However, there is a system for spousal tax reduction for spouses. In the above example, the inheritance amount inherited by the spouse is less than 160 million yen, so the inheritance tax for the spouse will be exempted.

next time"Inheritance tax declaration procedureI would like to introduce you to ``.

At Conspirito, we have a wealth of content on our website that you can learn from the perspective of a real estate management company.

The person who wrote this blog

Conspirit Blog Writer

Conspirito's official blog writer will deliver useful information about real estate.