Thank you for visiting us.

This is conspi public relations.

This time, it was distributed on CONSPIRIT's official channel on YOUTUBE.

"Episode 9: Boost your QOL with real estate management!"I would like to send you the contents.

Here is the theme for this time.

"Real Estate Appraisal - Part 1"

The reason why it is number 1 is because there are several standards for evaluating income-generating real estate.

This is a topic that is all too familiar to real estate owners, but this time we will be looking at one of the measures

“Profit return method”

First, the basic premise.

Why do we need a ruler?Is that price reasonable?please,

Is the amount logically explained?Please, we need a measure to judge that.

So, what types of rulers are there?

Some commonly used evaluation methods include:

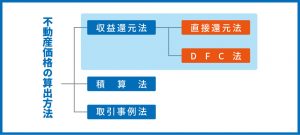

Part 1: Earnings capitalization method

Method 2: Integration method

Part 3: Transactional Case Method

This "revenue capitalization method"1) Direct reduction methodand,② DCF methodofThere are two types.

This time, the main focus is on individual property owners.

Used when making investment decisions

Of the income approach1) Direct reduction methodToAbout.

What is the income capitalization method?What can be gained from real estate

Net income for a certain period (usually one year)

This is a method of calculating the income price of real estate by dividing it by a certain capitalization rate.

It's difficult to understand just by explaining it in words, so let's replace it with a simple formula.

Example: Let's take a room in a condominium with a monthly rent of 90,000 yen.

The maintenance and operating costs for this room are "management fees and repair reserve funds of 10,000 yen per month,"

Let's say the annual property tax is 50,000 yen and the assessed capitalization rate is 5.0%.

So the revenue from this room is

(90,000 yen - 10,000 yen) = 80,000 yen x 12 months = 960,000 yen,

After deducting the fixed asset tax of 50,000 yen,

960,000 yen - 50,000 yen = 910,000 yen

This is the net profit for this room.

And the return rate is 5.0%.

910,000 yen ÷ 5.0% = 18.2 million yen

so,

If you were to use the direct capitalization method to value this property,

18.2 million yenThis means that the evaluation is as follows.

It's super easy.

When financial institutions evaluate used condominium units,

I think most people use this calculation.

As you may have noticed, in this calculation, the "capitalization rate" is

Depending on what percentage you set it at, it can make a big difference in the assessed value.

Applying this to the previous calculation example,

If the capitalization rate is 4.0%,

910,000 yen ÷ 4.0% = 227,500,000 yen

If the capitalization rate is 6.0%,

910,000 yen ÷ 6.0% = 15.16 million yen

It becomes.

This shows how the capitalization rate setting affects the appraisal.

So, what is this important capitalization rate?How is it decided?That's what I mean.

It can be roughly divided into two patterns.

The first is to look at examples of transactions of similar properties in the surrounding area of the property,

A pattern in which the yields of properties currently for sale are used as a reference value.

The second is through real estate companies, portal sites, databases, etc.

A pattern that refers to published yields by area.

So, although it is important, it is quite vague.

Is it possible for some authoritative institution to tell me exactly what kind of property is in this area, how many minutes walk from the station, and how many square meters?"what%"!

It would be nice if they could make that decision, but it's not that easy.

Some people may not mind a lower capitalization rate because the property is close to their home and in a familiar area.

Since I don't know the area well, I was drawn to the idea that the vacancy rate would be high.

It is also possible that a stricter capitalization rate will be required.

In short, since it reflects the angle and intentions of the person looking at it, it inevitably tends to be low in accuracy.

However, when assessing income-generating real estate,Currently the most popular methodis.

This is one thing that anyone planning to start a real estate business should keep in mind.

If you likeConspirit official channelPlease also take a look.

Please subscribe to the channel and give us a high rating!

Well then, it was Conspi PR!

The person who wrote this blog

conspirit public relations

We disseminate information both internally and externally to improve our company's awareness and brand power. We conduct promotional activities by clarifying reach methods based on market, competitor, and company research and analysis.